PRIVATE FUNDING FOR INVESTORS

Historical Interest Rates on Savings:

Real Estate Investing- Where to place your money

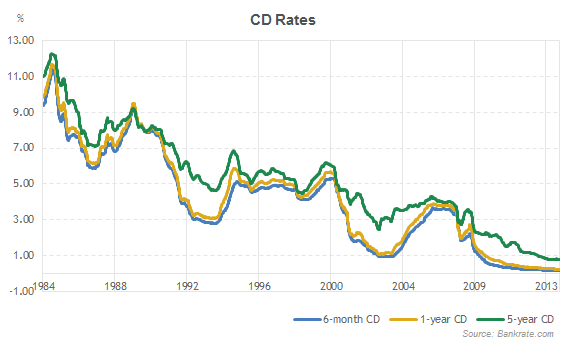

Where can you invest your money so it is secure and will yield you a constant return on your investment? As you can see by the above chart Bank rates are not the answer. Stop letting the Banks profit from lending your money out, do what they do and lend it out yourself.

The average Yield for the last 10 years in the Stock Market has been 7.235% But where is it going in the next few years? Not Bad but not locked in either. Private Notes are a locked in return for a specific period of time usually around 10% or more back by Real Estate

MAE Capital Mortgage Inc. strives to provide high-quality investment grade loans so our investors are protected and our borrowers receive good quality service with products that fit their demands. When you make the decision to invest in Trust Deeds with MAE Capital Mortgage Inc. you can rest assured that the combined 50+ years of lending experience is in your corner. We will only allow our investors to invest in 1st Trust Deeds with low loan to values.

Our Investors earn 9% to 13% annually

At MAE Capital Mortgage Inc. we know that your investments are secured by large amounts of equity in Real Estate. Turn your cash into a stable, high yield income producing investment through Real Estate First Trust Deed Investing. Best of all you control your investments by choosing what types of properties and loans you wish to invest in. You hold the Note on a property with equity if the borrower defaults you get a property with built in equity to sell or keep.

Have you suffered through the gyrations of the Stock Market or Bond Market? When you invest in Trust Deeds you will know what your yield will be, and best of all your asset is secured by a large equity position in Real Estate that you are fist position on.

Why First Trust Deed Investing with Us?

- We only entertain lending opportunities on properties that we can secure with a First Trust Deed as opposed to second mortgages that are much more risky.

- We underwrite our borrowers and assign risk to them for our investors. So if you are the type of investor that may like to take a higher risk for a higher reward you can take that approach. Conversely, if you are more on the conservative side you can pick those investments that better fit your needs. With higher yields for higher risk and lower yields for lower risks you choose.

- Compliance: As a fully licensed California Bureau of Real Estate Broker# 01913783 we have to comply with a higher standard not only set forth by the law but by our own codes of ethics. You know that your investment will be serviced by a higher standard.

- We Screen all our potential borrowers before we put them out to our investors so you can pick and choose as we get the clients which ones you would want to invest in.

- You can pick the terms that best fit your investing objectives. Once we have assigned risk to the transactions you can pick your terms that best fit your objectives.

- You are the Beneficiary in each transaction. Your name is vested on the security instruments (both the Note and Deed of Trust). If you have invested in a Whole Deed of Trust you are the sole beneficiary. We can only have up to 10 beneficiaries on a note at a time and in most cases we only use a single beneficiary depending on the needs of our investors.

- Your Investment is secure if the borrower does not pay, you get the collateral (The Real Estate) with all the equity in it.

- We spend time and money originating, researching, underwriting, and verifying every aspect of the loan file for you. You will receive from us the following at minimum to review an investment opportunity: loan application, preliminary title report, credit report, and appraisal.

- You know your Return on Investment (ROI), before making your final decision to proceed. It does not change like the stock market or other investments based on factors outside of your control

The Process:

- Once you have decided that investing in Trust Deeds is for you then we will have you have you fill out our Investor questionnaire so we know exactly what your investment goals are so we don't send you opportunities in areas you are not interested in.

- We then have you sign our Standard Loan Servicing Agreement that spells out our service and our fees. (If you want us to service the loan)

- You are put on our list of investors in the categories that you want to invest in.

- When you decide you want to make the investment in one of the opportunities offered, you will receive the BRE 851 form that spells out the transaction, a copy of the loan application, appraisal or internal valuation of property, a title report, potential borrower's credit and a risk assessment from MAE Capital Mortgage Inc. that spells out terms requested.

- Once you commit we will draw the loan documents with all the legal disclosures for the borrower.

- We send this to the escrow company where you will be directed to sign the necessary documents, such as the note and Deed of Trust.

- Once everyone has signed we will go over all the paperwork to make sure it is completed properly and legally.

- When we have determined that everything is correct and all the insurances are in place we will instruct you, the Investor/Lender, to wire the funds directly to the escrow, we will never handle your funds except to collect monthly payments from the borrower once placed into servicing.

- Once you have funded the loan the Escrow will balance the transaction and record the Deed of Trust in the county the property resides in and forward any fees that were instructed to be dispersed.

- Any pre-paid interest will be forwarded to you the lender so the payments can be set up to be delivered on the first of the month.

- MAE Capital Mortgage Inc. will collect the payments from the borrower each month and take the servicing fee out and forward you the investor your yield. (If we are servicing the loan)

**Disclaimer: Trust Deed Investing is not for everyone we encourage you to seek other advice or do further research before investing in Trust Deeds. Although the initial loan is backed by equity at the consummation of the Trust Deed we offer no warrants or guarantees that the equity position will remain the same throughout the term of the Trust Deed you invest in. The California Bureau of Real Estate has composed a guide for investors just click here to download.

Helpful other pages for Investors

Keywords: Trust deeds, Notes deed of trust, investing in deeds, investing in deeds of trust, investing in private notes, high yield investments, retirement accounts, high yield retirement, retirement income, more retirement income, Note income, how to invest in notes, how to invest in deeds, private money investing, private notes, private note yields, private deed of trusts yields, investing in private notes and deeds, private note servicing, note servicing, private mortgage lending, private money investing, self directed IRAs, notes in a SDIRA, investing retirement funds, investments with an income, income producing investments, monthly retirement income, secure investments, secure real estate investments, secure investment income, note income, real estate investor, investors, lending money, lending your own money, Sacramento investments, Roseville investments, high yield investments, low risk investments, low risk high yield investments, secured investments, secured notes, secured deeds, retirement investments, alternate investing strategies, long term investments, Note brokers, sacramento note broker, roseville note broker, rocklin note broker, broker for deeds of trust, broker for private notes, investment capital broker, real estate note broker, private money broker, private money broker Sacramento;lnto, Private money broker Roseville, Private money broker Rocklin, Private note servicer sacramento, private note servicer Roseville, private note servicer Rocklin, private note selling, private note originator, private note handler, private note maker, licensed loan servicer, loan servicer sacramento, loan servicer Roseville,