?

The Real Estate Process Flow:

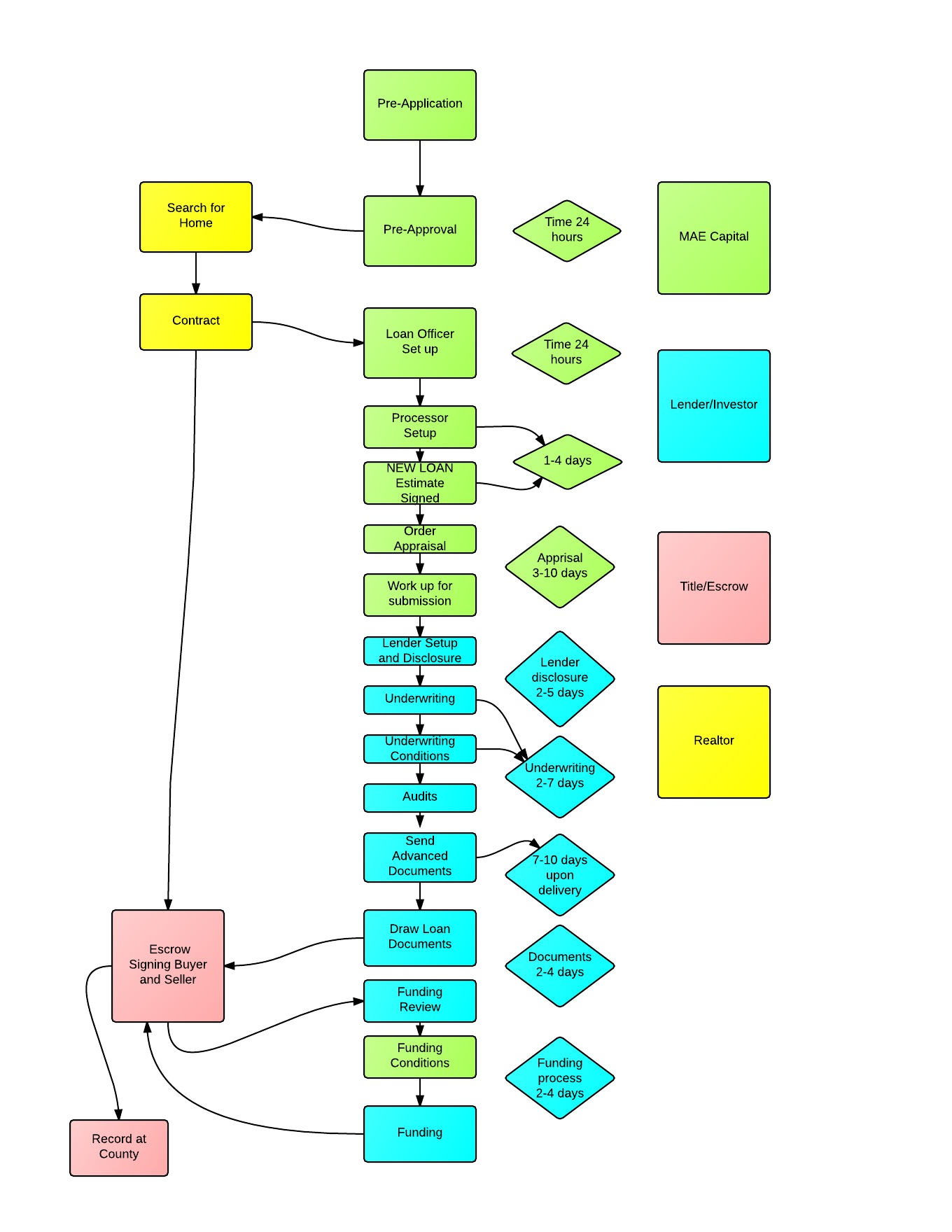

Our Processing times have improved dramatically over the last several years. We have refined the process flow to be able to close home loan transactions in 30 days or less. Below is an illustration of how the process flow works in all Real Estate Transactions in California and the players involved.

The Process Flow illustrated above shows the steps of a typical Real Estate transaction. The chart is color-coded to show the respective functions of the Real Estate Professionals. Note: that the time frames are estimates only and may vary with the complexity of a transaction or other factors. Time frames should be used as a guide not as an absolute, as there are many factors that contribute to time frames.

Definitions:

Pre-Application: Is the initial contact with MAE Capital is to just see if you can qualify to buy a home. We get basic information and have you send us your last 2 years tax returns; last 30 days of pay-stubs; last 2 months of bank statements or accounts to show where the down payment is coming from; W2's for the last 2 years; as seen on the loan application checklist. We will run a credit report to ensure credit is good enough. If you know you have credit challenges we will have you go to a free credit report site and pull it and you can provide that to us to help you start to clear your credit up without any new inquiries from us.

The Process Flow illustrated above shows the steps of a typical Real Estate transaction. The chart is color-coded to show the respective functions of the Real Estate Professionals. Note: that the time frames are estimates only and may vary with the complexity of a transaction or other factors. Time frames should be used as a guide not as an absolute, as there are many factors that contribute to time frames.

Definitions:

Pre-Application: Is the initial contact with MAE Capital is to just see if you can qualify to buy a home. We get basic information and have you send us your last 2 years tax returns; last 30 days of pay-stubs; last 2 months of bank statements or accounts to show where the down payment is coming from; W2's for the last 2 years; as seen on the loan application checklist. We will run a credit report to ensure credit is good enough. If you know you have credit challenges we will have you go to a free credit report site and pull it and you can provide that to us to help you start to clear your credit up without any new inquiries from us.

Pre-Approval: Once we have determined that credit is good enough and your income can support a payment we will run your information through our automated underwriting systems. These systems are FNMA and FHLMC systems, so when we get an approval through one of those systems we know you are OK to buy a home up to our approval amount. We then issue a pre-approval letter that you can submit your offer to purchase a home.

Search for a Home: Once you have the pre-approval letter in hand we will set you up with one of our qualified Real Estate Agents (if you don't have one) or we will let your Agent, know how much of a home to search for. You may also use our search engine to search for homes. Click Here

Contract: Once you have found the house that fits your needs, you and your Agent make an offer to purchase the home and negotiate the sales price. Once you and the seller have agreed upon the price and terms, and both have signed the offers and counteroffers you are now in contract to purchase that house. Your Agent may say that they are going to "open escrow", which is a term that means they will deliver the contract and deposit funds to an escrow company, usually of the sellers choice.

Loan Officer Set-Up: Once your Real Estate Agent has collected your deposit and an escrow company has been determined, your loan officer will give you a list of items that will need to be updated to complete the loan. Your MAE Capital Mortgage Loan Officer (MLO) will then contact the escrow company and order a preliminary title report to make sure the title is clean before you buy the house. Your MLO will gather all the fees that will be incurred in the transaction and prepare your disclosures for your review and signatures. He/She will then give the file to the MAE Capital Mortgage Processor. The Disclosure Process here.

Processor Set-Up: Your Loan Officer has completed all the necessary disclosure information and has handed the file to his or her Processor. A Processor's job is to check all the paperwork and order those items that by law a Loan Officer cannot such as the appraisal. The processor is important in the company's systems of checks and balances to ensure that all the information gathered is true and correct and complete. The processor will review and prepare the disclosures that have to be signed and check all the dollar numbers in the transaction to make sure you have enough money to close. New is the Loan Estimate which combines the old Good Faith Estimate and the Truth in lending forms. The Borrower must acknowledge receipt within 3 days of the application before anything else can be done.

Work-Up for Submission: Again this is a processor's function to re-check all the verified numbers such as income, bills, cash to close, and any explanation letters that may need to be presented to an underwriter. This art of working up a file is an art form that your Loan Officer and Processor use to paint your financial picture with documents to an underwriter. This is also the final time we determine what lender will fund your unique financial situation. All lenders have different guidelines and our job as a Broker is to know what lender(s) will approve your loan based on your unique financial picture.

Underwriting: An underwriter works for a Bank or Mortgage Banker, they have the job of determining if you are a good risk to lend money to. The Underwriter will go through all the paperwork we sent them and determine if you fit their guidelines or if they need more information from you to make a decision.

Underwriting Conditions; The conditions are items that an Underwriter will ask for to aid in their decision to approve your loan or not. Conditions can be anything from letters of explanation to court documents depending on your past financial history. The items will be itemized in the order of importance.

Audits: Most lenders have added this stage prior to drawing the legal papers to make sure the loan file is in compliance with all the current laws, regulations and guidelines. This is generally an internal process of the lender and can take up to a few days to get completed.

Send Advance Closing Disclosures (The CD): TRID (Truth in Lending RESPA Integrated Disclosure) New process started October 3, 2015. The Consumer Finance Protection Bureau (CFPB) has instituted this new process that will allow the consumer a "know before you owe" time period before signing the final Note and Deed of Trust and Escrow Instructions. The procedure will be for the Lender (formerly the Escrow Company) to prepare a Closing Disclosure statement that is to be delivered 3 days prior to the signing of the final Loan Papers. The delivery of the document will have to be acknowledged by the borrower before the 3-day period can start, and the 3 days are business days not including Sunday or Holidays starting at midnight the day the borrower signs. If the delivery method is to be done through the mail then it will be a mandatory 7-day wait. If at any point anything needs to be adjusted or changed regarding the costs of the loan, or if there are going to be any additional credits from Buyer, Seller, Lender or Brokers the process will have to start over again with the issuance of a new Closing Disclosure Statement. The variance in change that will trigger another disclosure and disclosure period is .125% of the loan amount.

**Update as of August 2018, all is going well with TRID and the new procedures, it still adds time and money for consumers, however. Escrows periods have improved Average of 30 days or less.

Draw The Loan Documents: The loan documents are the legal paperwork, such as the Promissory Note, Deed of Trust and Escrow instructions and disclosures. This paperwork is securely delivered to the escrow company for you to sign. The Loan Documents cannot go out until the necessary 3 days have passed after the borrower has acknowledged the CD.

Escrow Closing or Settlement: This is where you go to the Escrow/Title company and bring the remainder of your down payment and closing costs. You will be signing the Loan Documents and final disclosures. You may also be asked to bring additional documentation at that time as well. You will be given a HUD-1 closing statement that itemizes all your cost of the transaction. Click here for more details on the Escrow Closing process and requirements.

Funding Review: Before the lender will fund the loan they check it once more for accuracy and that all the conditions that were asked for by the Underwriter have been collected and signed off. Once they have determined everything is good to go the file is ready to fund.

Funding: Once everything has been checked off and signed off the lender will wire the funds to the escrow.

Recording: Once the escrow has verified that the funds have been deposited in their bank account the escrow will release the Deed to be recorded. Once the Escrow has confirmation that the county has recorded the transaction the house is legally yours. The Escrow will then disperse funds to the seller and everyone else who is entitled to a portion of the proceeds. Congratulations, the house is yours!

Keywords: loan process, loan processor, process flow of a loan, processing a loan, loan processing, processing info, loan officer process, process flow of a loan, how a loan works, what to expect in processing, processing lenders, lenders processing, mortgage process flow, mortgage process, mortgage processing, processing a mortgage, processing a loan, loan process, flow of a loan, escrow process, what is the escrow process, define the escrow process, the process of an escrow, what is an escrow, what does escrow mean, the mortgage escrow process, escrow processor, the process of an escrow, why escrow, the steps of an escrow, escrow steps, step of an escrow, escrow processor, loan escrow process, escrow loan process, why escrow, title process, real estate escrow process, real estate loan process, real estate process, escrow, real escrow, mortgage escrow process, what happens when I buy a house, what to expect when buying a house, California loan process, California loan process flow, California loan processing, Mortgage processing flow, California FHA process flow, California VA process flow, process of buying a home, home buying process, Real estate process flow, what happens when buying a house, process of buying a house, loan qualification flow, loan paperwork flow, how a loan works. how a home loan works, what is the loan process, processing a loan to close, loan procedures, knowing the loan process, knowing the real estate process flow, a loan workflow, a real estate transaction flow to finish, the flow of an escrow, what is the flow of an escrow, the steps to an escrow, image of process flow, image of real estate transaction, steps to a loan, steps to a real estate transaction, what to expect in a real estate transaction, what to expect in a loan transaction, research real estate, research loans process, research mortgage process, research mortgage loan, research mortgage process, research real estate process, research escrow process, the flow of a real estate transaction, the flow of a real estate loan, TRID procedure, new closing times, tried closing times, TRID process defined, TRID October 1, mortgage changes 2015, CFPB TRID changes, what is TRID, Process flow with TRID, TRID process flow. TRID closing times, changes to the real estate industry, CFPB changes, CFPB longer escrow, why longer escrow, CAR longer escrows, CAR TRID, CAR TRID process, Impact of TRID, TRID CFPB, New mortgage process flow October 1, What will be the mortgage process, How to write a real estate contract, how long to write and escrow, Real Estate times, time it takes to close a real estate transaction, time it takes to close an escrow, TRID process flow, TRID processing, process flow with TRID, new loan process flow, CFPB loan process, borrower loan process, loan disclosure process, loan disclosures, The Process of getting a home loan, what is the home loan process, loan process, new loan process, what changed with TRID, Loan Documents, The loan Estimate, what is a loan estimate, what does escrow do, what does a lender do, getting a home loan, what is involved with a home loan, processing a loan, what is processing a loan, best loan processor, Loan Docs, Funding a home loan, how does a home loan work, what do I need to know about home loans, what happens when I apply for a loan, the loan process, what is an underwriter, home loan funding process, home loan process, home funding process, how do home loans work, no income loans, no income qualifying loans, Real Estate Process, what is the process of buying a home, How has TRID affected the home loan process, show me the steps to purchase a home, home purchase procedure, home buying procedure , the flow of real estate, the flow of a real estate transaction, what goes on during the loan process, how does buying a homework, what can i expect when I buy a home, Loan process detail, detailed loan process, detailed home buying process, TRID loan flow, Home loan process flow, escrow time, close of escrow time, how long does it take to close an escrow, why does it take so long to close an escrow, what is a COE date, why does it take so long to get a home loan, what is a CD with regards to a mortgage, Mortgage Processing flow, Steps to closing on a house, Escrow process, what is an escrow, what is the flow of a REal Estate Transaction,hat to expect when getting a home loan, average escrow turn times, show me the real estate process. the illustrated real estate process, the Real Estate process illustrated, real estate flow chart, define the real estate process, show me the process of buying a home, #preapproval, #loanapproval, #realestateprocess, the typical real estate transaction, typical loan transaction, how real estate works, steps to buying a house. home buying basics, what to expect when buying a home, Home Loan time frames, how long does it take to get a home loan, Real Estate process, Real Estate flow chart, Real Estate process, know how the Real Estate process works, Eat that